VT Protean Capital ELDeR Fund

The ELDeR Fund takes an institutional approach to investing in the $2 trillion defined return investments market: by breaking defined return investments down into their constituent parts, and investing in those building blocks separately, we are able to effectively manage risks and secure attractive pricing opportunities.

Liquidity and risk management are central to the ELDeR Fund strategy. The ability to enter or exit positions when better pricing opportunities become available, no matter what market conditions prevail, is crucial. Our approach to risk management derives from the original objective of defined return investments to dampen or protect investors from full downside of the equity markets. This principle is enshrined in the ELDeR Fund’s risk control, and we target a risk that is one third to one half that of equity indices. We only seek to maximise expected returns to the extent that they are consistent with this target.

The strategy carries low correlation with other major asset classes, and we believe the fund adds value as an alternative investment to a wide range of portfolios and risk categories.

- Unrivalled derivative research and trading expertise

- Risk driven portfolio construction

- More stable risk profile suitable for risk-rated and risk-budgeted portfolios

- Market leading costs

- UCITS fund eligible for SIPP, ISA and Offshore Bonds

Downloads

Distribution Enquiries

LGBR Capital is the appointed distributor for the VT Protean Capital ELDeR Fund

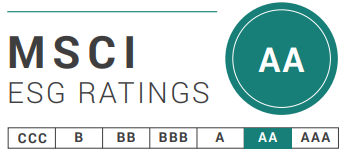

Disclaimer: MSCI ESG Research LLC’s (“MSCI ESG”) Fund Metrics and Ratings (the “Information”) provide environmental, social and governance data with respect to underlying securities within more than 31,000 multi-asset class Mutual Funds and ETFs globally. MSCI ESG is a Registered Investment Adviser under the Investment Advisers Act of 1940. MSCI ESG materials have not been submitted to, nor received approval from, the US SEC or any other regulatory body. None of the Information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. None of the Information can be used to determine which securities to buy or sell or when to buy or sell them. The Information is provided “as is” and the user of the Information assumes the entire risk of any use it may make or permit to be made of the Information.